Few belief systems in contemporary Western political-economic thought are as entrenched among our academic and political elite as their collective faith in the unqualified, exclusively positive benefits of global “free trade.” It is at once a woozy political affectation and an arid economic abstraction; essentially, an a priori conviction that is—in its layman formulation, anyway—as imprecise as it is likely to evoke strong, seemingly religious passions among its adherents.

“[W]hatever may be the motives of free traders, when they promote free trade under the pretense that already-wealthy nations like the United States will become 'wealthier' by its practice, it’s hard to believe that this is really part of their agenda.”

Having chugged Paul Samuelson’s classic economics textbook as a chaser to his stronger mixed Marx-and-Mao libations from the groovy spaces of his Ivy League coffee lounge back in the ‘60’s, today’s free trader of left-leaning persuasion in any position of partisan authority is less likely to feel triggered by the term “fair trade” than are his right-wing colleagues. Left-wing “fair trade” takes the meta-view that all nations are friendly trading partners, working together for the benefit of all mankind, but especially “workers”; while right-wing “free trade” embraces the view that national competition on a global stage is the driving force for individual innovation and the continually increasing prosperity of all humanity. The right-leaning “free trader” rolls his eyes at this feel-good distinction, preferring his terminology neat, like his scotch. And so, at the end of every speech on anything even remotely economic, he offers a gregarious, unapologetic valedictory toast to the poverty-erasing wonders of unfettered “free trade.”

Either way, the success of each individual nation is said to be somehow a function of how “free” (or, if your palette prefers watered-down whiskey, “fair”) its trade policies are. This assertion is made a priori in the form of a prediction whose future results are (ahem) irrefutable, though politically savvy advocates are very studious to avoid any a posteriori review of actual results.

Both bi-partisans have, at all events, imbibed some flavor of the free trade Kool Aid of the West’s foreign policy establishment. Both believe passionately, regardless of their other irreconcilable differences, that the one true path to global peace and prosperity is paved entirely by the methodical—and, if necessary, involuntary—imposition of the international division of labor on every square hectare and nautical mile of the planet.

And this is the beginning of clear thinking on this subject: namely, that global division of labor is what “free trade” is really all about, not international trade in the sense most people understand it—as it was defined and practiced, in fact, until very recently. The difference between these two concepts is not trivial, but indeed quite fundamental; and the consequences of this deception have been nothing short of world-changing.

2.

If there is any consensus issue between establishmentarian left and right in Western civilization at present, “free trade” is it. Accordingly, both Brexit and the very idea that Donald Trump won fair and square in 2016 have had a psychologically catastrophic effect on them.

In economics, progressives and right-leaning neo-liberals (neoconservatives and Never Trumpers) disagree only on the particulars of whether the new international order they both promote shall be governed primarily by means of a command-and-control (“socialist”) or by a contractual (“capitalist”) legal superstructure.

For both believers, the notion that such a global superstructure is inherently unworkable, or even dangerous according to either scheme, is, well, simply not a proposition that their minds can process without exposing their cognitive dissonance. So, along come two illusion-destroying electoral rejections of their grand Babel 2.0 plans, first in the form of Brexit, and then made flesh in the form of the Trump presidency, and only the collective mental breakdown we have witnessed since could possibly have followed. They will never accept the idea that human nature can’t be changed by tax inducements and regulations, and besides, don’t really believe in the values of human freedom and democracy in which they claim to trade. Certainly the NBA’s recent bootlicking of communist China in the face of their crackdown on student protests in Hong Kong revealed what really matters to our capitalist elite.

These passions, moreover, are triggered by the slightest contact with any “crazy fringe talk” of “tariffs” or “regulation of trade” being simply tools of good government—as America’s founders saw them, for example. Or as Trump wields them, for another. These and other “interventionist” heresies provoke salaam convulsions in “free traders,” whether the true believer in the nigh “global economy” hails from the ostensible left or the ostensible right. On this matter, their world-messianic ambitions align, and so their organs of ratiocination are enslaved to the exigencies of those ambitions. As one of my favorite Federalist Papers, No. 31, puts it:

In disquisitions of every kind, there are certain primary truths, or first principles, upon which all subsequent reasonings must depend. These contain an internal evidence which, antecedent to all reflection or combination, commands the assent of the mind. Where it produces not this effect, it must proceed either from some defect or disorder in the organs of perception, or from the influence of some strong interest, or passion, or prejudice …Men, upon too many occasions, do not give their own understandings fair play; but, yielding to some untoward bias, they entangle themselves in words and confound themselves in subtleties [emphasis mine].

Such alignment across ostensible ideologies is possible because it is based on a clever, fundamental deception. It is, moreover, a primary truth deception, for which weak-minded partisans across the spectrum easily fall, for various ideological reasons. As I’ve said, this deception, hidden in the very language of the debate, is the slippery conflation of trade with division of labor. It’s subtle until you notice it, at which point you can’t unsee it. This sleight of hand cunningly renders the term “trade” meaningless in the whole discussion, while at the same time embracing, even incorporating—dare one say appropriating?—it. And with it, very idea of nations also magically disappears, so disintegrate they must. Is this not the hallowed purpose of the “United” Nations—a one-world government, whose collective will no one nation can oppose?

3.

In free market economics, trade has traditionally been defined as the exchange of economic surplus between geographic markets. Or, to be more precise, it is the exchange of such surplus between economic systems, whose boundaries are determined politically. Division of labor, on the other hand, is the exchange of goods and services between individuals within a market or economic system. Now these are entirely different phenomena, requiring separate theoretical frameworks in order to reason about them clearly—not to mention a consistent definition of the term economic system from which to begin such inquiries. Buzzword-bingo rhetoric of the sort regurgitated daily by the chattering class on cable business news regarding the mercurial real-time movements of labor and capital across the “global economy” masks all the thorny political and philosophical question marks otherwise lurking in plain sight here.

For example, within the “free trade” rhetorical framework, the complicated economic concept of division of labor hides like a stowaway assumption in the water closet of easier-to-understand laymen’s idea of trade, so that the true nature of the discussion is disguised in simplistic equivalences of “national interest” to “individual interest.” That is to say, nations “trade” with each other just as individuals do, according to this magician’s logic; in “their “own interests,” seeking “mutual benefit.” Notice, then, how “trade” has subtly become one with division of labor the moment the mind accepts the metaphor. And more than that: notice how nations rationally choose between courses of action, not merely whether to “trade” goods and services which they have in excess (a fairly straightforward process), but also what goods and services to produce in collaboration with other nations! This latter idea is much more sublime and radical, in ways that obscure the facile equivalence of nations with rational individuals.

Anyone who has observed with dispassion the “organs of ratiocination” by which nations (especially “free” and “democratic” nations) “rationally choose” their economic and foreign policies in the course of messy, real-world human affairs would get a good chuckle out of this hidden assumption. But then, that’s why it’s hidden. And one supposes that the free trade true believers, the ones who really know what the aim of free trade is, must quite enjoy that chuckle, too—privately.

4.

In fact, the end of “free trade” versus canonical “trade” is something else altogether. It has a different goal—which requires that its frame of reference for “rationally choosing” economic means cannot be the same as the frame of reference of the traditional advocate of international trade.

To put it bluntly: “free trade” does not care one iota about the goals of particular nations; rather, it sees nations as obstacles to collective progress (for the left-wing free trader) or to human freedom (for the right-wing free trader). It takes a more abstract view of society—or, more precisely, of social collaboration—than does traditional political economy. But it is helpful to their cause that partisan dupes on all sides in any national political context fail to see how directly this globalist frame of reference conflicts with national interests all partisans claim to advance. Thus, they say with a straight face that “free trade” will of course make America wealthier (than non-free trade). And it follows of course then that “non-free” trade will make America less wealthy. Here blind faith sustains partisans even in the face of contrary evidence.

The law of equilibrium, they knew full well, all but guarantees a decline in capitalization of American labor as global free trade “naturally” forces capital to flow from the United States, a high-wage country, to regions of the world with “cheaper” (that is, low-wage) labor. For in the mind of the free trader, the fact that one country might pay higher wages to their workers is due to “unnatural” and “artificial” conditions” created by the existence of nation-state boundaries that inhibit the free flow of labor and capital, upon which a world system must depend. This leveling of wage-price structures across the globe, necessitating a dip in standards of living in high-wage countries in order to lift wages in poorer countries, is a feature, not a bug, to the committed free trader.

Canonical trade accepts nation-states as both historical fact and a practical reality. It seeks therefore to support international exchange of goods exceeding demand of each country’s home market, so that it meets the following constraints as far as possible: a) none of it goes to waste; b) deficits in home-market production can be offset by “excess” foreign production; c) national income or return on capital investment is maximized. The assumption that every country gets what their home markets want, no more no less is clear as day in the writings of economists from Adam Smith until, but not including, David Ricardo, and makes perfect sense when framed in the plain language of national political economy. But that “zero sum game” mentality of which free traders accuse conservative opponents of free trade is far more applicable to current Chinese trade policy than to any goal of America’s founding “protectionists,” who were steeped in the ideas of their contemporary, Smith. Although he is called “the first free trader” by contemporary free traders, Smith was simply the first economist, and his attitude toward international trade was framed in terms of achieving national political objectives.

In Book 2, Chapter 5 of his Inquiry into the Nature and Causes of the Wealth of Nations, in which he considers the general employment of capital, Smith says:

The capital, therefore, employed in the home-trade of any country will generally give encouragement and support to a greater quantity of productive labor in that country, and increase the value of its annual produce more than an equal capital employed in the foreign trade of consumption: and the capital employed in this latter trade has in both these respects a still greater advantage over an equal capital employed in the carrying trade. The riches, and so far as power depends upon riches, the power of every country, must always be in proportion to the value of its annual produce, the fund from which all taxes must be paid.

In other words, given a unit of economic resource, domestic production for domestic consumption by definition produces more national wealth than the same quantity of capital employed in domestic production for foreign consumption, or foreign production for domestic consumption (that is, what Smith refers to as the “foreign trade of consumption,” or “import/export”). The “carrying trade” is akin to that retail infrastructure which facilitates long-distance import/export, and has even less value in terms of capital accumulation—it’s basically overhead.

The reason domestic production for domestic consumption produces more wealth than alternative uses of the same quantity of capital is that both “jobs” involved in the “exchange” are domestic. By definition the same quantity of capital employed in domestic production for domestic consumption employs twice the quantity of productive domestic labor and therefore contributes twice as much with respect to national domestic wealth accumulation than if employed in the buying and selling of products in foreign markets. Later, as we’ll see, the Austrians explain the significance of this process of capital accumulation even better, when considering the related term standards of living.

And what is the underlying purpose of this employment of capital? Smith puts it in plain, almost Trumpian terms:

But the great object of the political economy of every country, is to increase the riches and power of that country. It ought, therefore, to give no preference nor superior encouragement to the foreign trade of consumption above the home-trade, nor to the carrying trade above either of the other two. It ought neither to force nor to allure into either of those two channels, a greater share of the capital of the country than what would naturally flow into them of its own accord.

So why trade at all? His answer is immediate and inline:

When the produce of any particular branch of industry exceeds what the demand of the country requires, the surplus must be sent abroad, and exchanged for something for which there is a demand at home.

Trade turns excess production on both sides of a trade relationship, production that would otherwise be wasted, into social good, finding the optimal distribution of that production in the very act of exchange:

When the foreign goods which are thus purchased with the surplus produce of domestic industry exceed the demand of the home-market, the surplus part of them must be sent abroad again, and exchanged for something more in demand at home.

Such is the free market view of trade that Smith articulated. The American founders understood it and adopted it with a few innovations of their own. Let’s call this the nationalist view, in contradistinction to the neoconservative view with which Americans are now more familiar.

America’s founders, after all, were Smith’s contemporaries, and sought national independence in 1776, the very year that he published his great work, which showed them how to achieve it. Evidence that Hamilton in particular grasped the key ideas in Wealth of Nations abounds in his famed Report on Manufactures, which arguably laid the foundation for America’s rapid rise as a leading industrial power—a status that seems inevitable in retrospect. At the time the ideas were quite new, controversial, and indeed unproven.

The point is that the nationalist free market view of America’s founders, ignored altogether by modern economists like Samuelson on account of its use of tariffs not just as trade tools but as part of a systematic approach to sustaining federal revenues, is neither temperamentally xenophobic nor knee-jerk anti-trade. Nor is it a mercantilist point of view.

Nationalist economics fits into none of those categories. It simply sees trade as a by-product of the gainful employment of national capital, intended merely to rectify natural inefficiencies, that is, surpluses and deficits in the satisfaction of the home market’s demand. The infrastructure of international trade (what Smith calls the “carrying trade”) is merely a sign of healthy economic activity, not its cause. Smith says as much, too, in the form of a warning:

The carrying trade is the natural effect and symptom of great national wealth; but it does not seem to be the natural cause of it. Those statesmen who have been disposed to favor it with particular encouragements seem to have mistaken the effect and symptom for the cause.

How different is the counsel of our modern “free market” sages! How unlike Smith’s is their reasoning! Trade itself, they insist, is the very engine of national wealth creation. Still, no fair reading of Smith, or any acceptance of the methods of his analysis, can possibly lead one to this conclusion.

On what principles or practices are they basing the modern idea of the free market? Was Smith simply wrong—or did something else change? Did the philosophical objective perhaps morph into wealth accumulation without regard to the wealth of nations? And where does that idea lead?

5.

Before Ricardo, economists did not seriously entertain the notion that “rich” countries had any strictly economic reason whatever to trade with “poor” countries; at least, no reason outside what economists now call the framework of “absolute advantage,” where one country or the other has a demonstrably superior productive efficiency in this or that industry (all other things being equal).

There may be many non-economic reasons for trade—or to be more precise, reasons not solely pertaining to the kind of mutual financial self-interest promoted by advocates of free, unhampered markets. But according to classical economics, rich countries would, by virtue of their superior productive efficiencies, and for so long as they could be sustained, always enjoy an absolute advantage over poor countries in almost any industry, and therefore would rarely have any practical reason for trade with them. Classical economics did not see “cheap” labor as somehow necessarily “more productive” labor, either.

So it was formerly quite clear that nations would have no purely economic reason to trade with each other, unless one or the other had some “absolute” productive advantage in some industry, often producing a surplus relative to domestic demand that could be used to cover a production deficit in the other. Somewhere along the line, however, this eminently rational, nationalist way of doing business was deemed a lamentable state of affairs. All these messy surpluses and deficits were summed up in one loaded word: inefficiencies. The presence of inefficiencies which had provided the justification for canonical trade must be a sign, some idealists insisted, that there was a better way to frame the whole question of “doing business” on the grander scale.

Surely there must be some arguably “economic” rationale, the early globalist dreamers conjectured, for rich countries to “share” their bounty with poor countries, and for poor countries to contribute to their wealthier counterparts in some mutually beneficial way! There must be some way to bring about a world based on the sharing of prosperity, which would enable us to dispense with such irrational and antiquated notions as national sovereignty and domestic loyalties, so that wealth could be spread as widely as possible!

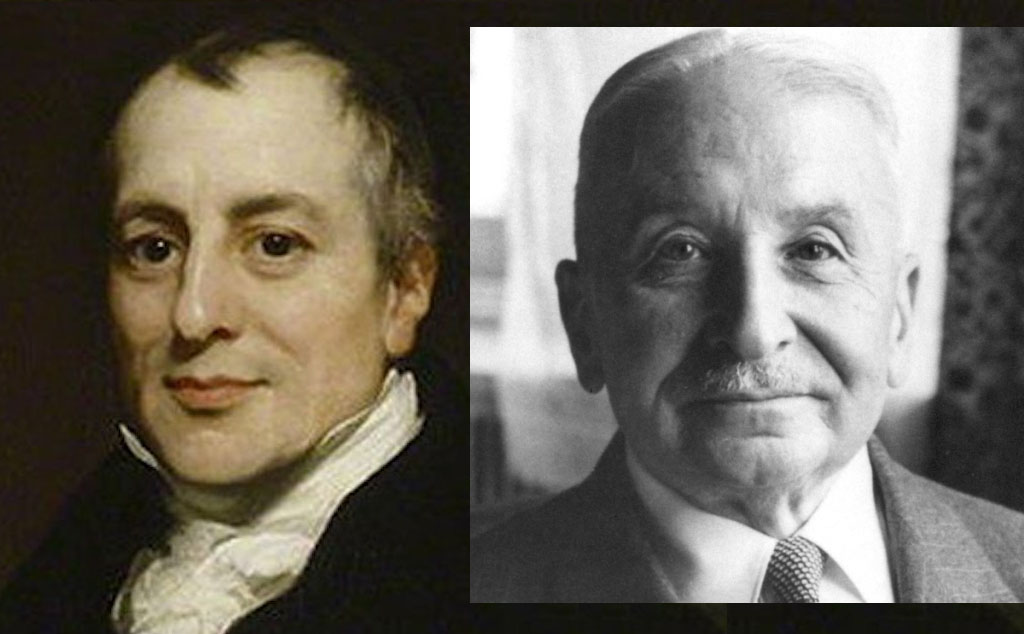

Along came Ricardo, with his penchant for abstract mathematical modeling, and his “labor theory of value”—the basis of later Marxist economic theory. His exquisite sophism known today as the “law” of “comparative advantage” paved the way for the neo-liberal rationalism that characterizes economic thought in the modern era.

Or, more accurately: Ricardo’s “comparative advantage” argument for rich countries trading with poor countries was repurposed by economic rationalists to provide a deceptively simple rationale for division of labor between nations, or rather, between all the peoples of the world without regard to nations. This arrangement entails profound changes to each country’s social order, even to the point of changing the nature of their governments, as well as the shape of their borders and the policies that regulate and enforce them. But before such radical political change, first they needed to be persuaded of the economic wisdom of “merely” relaxing their borders.

6.

Often the least effective presentation of an idea comes from its harshest critics, since it’s much easier to attack straw men than to grapple with actual ideas. An exception should be made, however, in the case of the Austrians, for, in the course of laying theoretical waste to the very foundations of David Ricardo’s labor theory of value, the key to understanding his entire framework, they nevertheless elevated his theory of “comparative cost” as rationale for free trade to a lofty status, namely, the “law of comparative advantage.” Their presentation of this particular idea was, if anything, too generous.

The Austrian school was founded by Eugen Böhm von Bawerk and popularized by Ludwig von Mises and Friedrich A. Hayek. Mises’ magnum opus, Human Action: A Treatise on Economics, explores a wide range of subjects in the course of attempting to expound a new science of praxeology (the science of human action). Praxeology is composed of philosophy (the science of ends) and economics (the science of means), and they are meant to keep their distance, the latter being strictly subordinate to the former. Now an economist, to be sure, does not speak of the desirability of an end or goal; rather, he determines whether resources on hand and the timescales involved render it feasible or infeasible. The end or goal itself and its worthiness has already been determined, by philosophy. Mises’ praxeology was a formal break with the traditional notion of “political economy” as a kind of tradecraft, which Mises judged—correctly, by and large—to be a source of subtle but profound intellectual errors.

Of course, cleanly separating these concerns helps us to think through difficult issues properly, and yet, as the saying goes, “the difference between theory and practice is bigger in practice than it is in theory.” Small wonder, then, that Mises’ strict differentiation between philosophy and economics, so critical to his underlying thesis and the Austrian approach of “methodological individualism,” is not one that he himself always maintains with the rigor he pretends to, at least not as regards Ricardo’s “comparative cost” approach to trade. He, like most free traders, glosses over many thorny feasibility issues involved in Ricardo’s framework, perhaps because he too is smitten with French free trade economist Frederick Bastiat’s fever-dream of an “ecumenical, indissoluble union of the peoples of the world,” a one-world system.

Ricardo originally devised his comparative analytic theory of trade in response to classical economists’ indifferent shrug on the question of why rich nations generally didn’t trade with poor nations. His goal was to come up with an economic rationale for the philosophical objective of lifting poor nations up, a goal for which economists of his day had no strictly economic justification, at least not one based solely on trade. His analysis always involved exactly two nations, A and B, and exactly two products, X and Y. This method was necessary because if all nations and all products are involved, the math gets, well, a bit messy, to the point of being unworkable. The novelty of his approach was that, thus constrained, the math appears to work. If wealthy country A “shifts” units of economic resources to the product that, relative to the poor country, it is “more superior” at producing, and away from the product that it is relatively “less superior” at producing; and if, moreover, poor country B uses all or most of its economic resources to produce the product that it is relatively “less inferior” at producing, then more of everything could be produced for both countries, thereby eliminating alleged inefficiencies of the non-free trade approach. (If the clumsiness of “more superior” and “less superior” bothers you, you are starting to get the point.)

The subtle shift here is that a country’s “home market” (as Smith would have termed it) no longer determines what gets produced by whom and in what quantity to satisfy its needs. Rather, the two markets are now one and determine these things via division of labor, not through trade. There’s effectively no distinction, in other words, between the home market and the foreign market, and little autonomy in the matter: Whoever in country A was producing product Y might have to find another job to accommodate the rejiggering of investment flows to product X; and whoever in country B was producing product X, well, he’d have no choice but to retool to produce product Y. Or to immigrate to country A, where production of product X is increasing to accommodate this new arrangement, resulting in a need for skilled labor.

The implications, though not evident to everyone, are massive. For instance, what if the two markets are culturally or politically incompatible? Let’s say the wealthy country, America, is a free market liberal democracy, and the poor country, China, is a communist dictatorship. Exactly how do fundamentally incompatible societies “cooperate” in this international division of labor? We shouldn’t assume, surely, that greater production and cheaper products justify the unintended negative social consequences of quasi-union between two economies. Even if America’s corporate elite managed to overcome their polite objection to China’s slave-labor conditions—which, let’s be honest, lures investment capital away from American labor—will laid-off American workers not find that long-term lower real wages offset the near-term gain of goods being cheaper? All other things being equal, the law of equilibrium guarantees it. Wages and prices in a system are interrelated—Austrians call it the “wage-price structure” of a market—and the relationship between them is sensitive to capital flows.

Then too, what happens when a third country is involved in the tidy back-of-the-envelop calculations? What if in relation to country C, country A has the inverse advantage—relatively “more superior” at producing product Y and relatively “less superior” at producing product X? Must country A now shift units of economic resource both into product Y and simultaneously away from product Y? At the same time as it’s shifting capital from Y to X in relation to country B? The more you think about real-world scenarios, the more the whole thing falls apart. Thus, granting that the math is calculable at some macro level, it remains too complicated for almost everyone to compute. And how few people make the decisions about what to produce and how much! Does this sound like a free market anymore?

And that’s not even the worst part. All this rejiggering of capital investment flow changes things. There’s no such thing as static advantage when capital flows alter the productive capacities of nations. The Japanese auto industry was a joke compared to American automobile manufacturing, until capital flows into Japan’s auto industry, brought about by “free trade,” turned Japan into an automobile producing powerhouse—anything but a joke to American auto workers.

Despite its simplicity and studious avoidance of any messy real-world issues, today Ricardo’s “law” is accepted and taught as gospel, and according to Paul Samuelson in his famous textbook, is “irrefutable” besides. But anyone familiar with the Austrian school’s signature contribution to economic theory, namely, methodological individualism, should find it quite odd that they would so fiercely defend Ricardo’s law while discrediting the rest of his theory, as its framing of the economic problem looks nothing like their own. Ricardo’s law did, at any rate, serve Mises’ philosophic purpose: free trade itself had to be treated as the goal, not just the means to a goal.

Thus, while effectively decrying the Smithian discipline of “political-economy” as a heretical intermingling of philosophy with economics, Mises, it seems, uses Ricardo’s framework for trade disingenuously, in order to establish his own vision of political economy. For Mises, it is “superfluous to develop a theory of international trade as distinguished from national trade.” Why? Because in his political theory, nations themselves are, by virtue of their “artificial” borders, “superfluous” obstacles to the global equalization of wage-rates, for which there is otherwise a “natural” tendency (that is, the “law” of equilibrium).

Committed to such “progress,” our free traders seek to “free” us from wage disparities imposed “artificially” by national borders. The free flow of labor and capital across borders, so beneficial to the stockholders of transnational corporations, is therefore essential to their geopolitical objectives. What are these objectives, what is the goal, if not world union? And must they not conflict—someday violently—with the aim of each nation to increase its wealth and power? Alas, few people are aware, it seems, of what a powder keg such easy-breezy wishing for a one-world system really is.

But whatever may be the motives of free traders, when they promote free trade under the pretense that already-wealthy nations like the United States will become “wealthier” by its practice, it’s hard to believe that this is really part of their agenda. The corporatists who use free trade’s purely economic arguments to advance their narrow, bottom-line objectives in moving jobs from America to low-wage nations can hardly be accused of philosophical dishonesty; they seek only their own shareholder profit and make no bones about that. Smith spoke of their type with contempt. To be sure, it’s not that free traders want America’s decline so much as they are indifferent to it. For something much better than American greatness awaits all humanity. Perhaps, like Nimrod, the free trade fabulists dream of a stairway reaching up to heaven through the spiral of prosperity, built brick by brick on the international division of labor.

7.

Mises writes:

Now, Ricardo’s assumptions by and large held good for his age. Later, in the course of the nineteenth century, conditions changed. The immobility of capital and labor gave way; international transfer of capital and labor became more and more common. Then came a reaction. Today capital and labor are again restricted in their mobility. Reality again corresponds to the Ricardian assumptions [emphasis mine].

“Then came a reaction,” indeed, in the form of the upheaval of two world wars. The international trade regime of the last 40 years has restored the “progress,” interrupted by the wars, that Mises saw in human affairs toward complete mobility of capital and labor. And, once again, there has been a reaction, namely, Brexit and the ascendency of Trump, each a threat to the neoliberal international order and its open borders gospel.

It is important to understand that, for all their pretense of putting economics (the science of means) in the service of philosophy (the science of ends), the Austrians used Ricardo’s abstract economic rationalization for trade, based on relative versus absolute advantage, as an economic “law” that strictly forbids philosophical concerns to trump its inexorable and irrefutable logic. To this end, the philosophical glorification of selfishness and the pitting of individual will against any form of collective will (be it family or state) needed a solid theoretical grounding. That is just what methodological individualism provided. Economists have built upon its foundations to reinforce the primary truth assumption that allows today’s student to fall for the conflation of trade with division of labor. Consider, for example, Paul Samuelson’s use of Adam Smith’s famous “invisible hand” passage as an epigraph to a key chapter of his popular textbook:

Every individual endeavors to employ his capital so that its produce may be of the greatest value. He generally neither intends to promote the public interest, nor knows how much he is promoting it. He intends only his own security, only his own gain. And he is in this led by an INVISIBLE HAND to promote an end which was no part of his intention. By pursuing his own interest he frequently promotes that of society more effectually than when he really intends to promote it.

Here we have the Gordon Gekko “greed-is-good” philosophy of contemporary libertarianism. Greed, or naked self-interest, is the actual engine of social good. But is this what Smith really says? By no means! Still, most people who have opinions on economics believe it is—a testament to the baleful influence of Samuelson. It is instructive to contrast the passage above with Smith’s words in context, so as to grasp how deliberately the later economist butchers the master’s conclusion:

But the annual revenue of every society is always precisely equal to the exchangeable value of the whole annual produce of its industry, or rather is precisely the same thing with that exchangeable value. As every individual, therefore, endeavors as much as he can both to employ his capital in the support of domestic industry, and so to direct that industry that its produce may be of the greatest value; every individual necessarily labours to render the annual revenue of the society as great as he can. He generally, indeed, neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end that was no part of his intention. Nor is it always the worse for the society that it was no part of it. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good. It is an affectation, indeed, not very common among merchants, and very few words need be employed in dissuading them from it [emphasis mine].

This passage is the culmination of Smith’s examination of the functions of capital; it explains why, for Smith, some nations become wealthy, while others do not. Note the complete lack of ellipses or other indicators in Samuelson’s clearly very heavily edited “quotation” above. One has to go to Smith’s text to see that his words have been gutted.

In our country today, there is hardly a leader in either party who did not imbibe some such disingenuous rendering of Smith’s most interesting conclusion, spoon-fed as it commonly is via inaccurate economics textbooks. It is likely that few, if any, of our leaders have read anything in their history books tying America’s early “protectionist” trade policies and “tariff revenue system” directly to Smith’s then-new concept of how national wealth is created. Accordingly, for the ruling elite, the idea of national independence and self-sufficiency is anathema, a threat to unbridled individualism, although they probably can’t even explain why.

The maleducation of our contemporary leaders, combined with the narrow profit-seeking of corporate culture, explains why the mainstream political parties are so out of touch with ordinary citizens in the U.K. and the U.S.A. They are unable to fathom why both “uneducated” working-class and middle-class citizens in the West have come to view ideological “free trade” policies as inimical to their individual and collective self-interest.

8.

The great irony is that Mises the economist could have explained how right the American founders were, if only Mises the philosopher hadn’t fundamentally objected to their goal. We have more than a clue of how approving Mises “the economist” would have been, had he applied his economic theory to the philosophical objective of American independence and self-sufficiency. In his 1952 talk, “Capital Supply and American Prosperity,” Mises the economist says with characteristic insight and precision:

The American government is considered as better than that of Italy or of India because it passes to the hands of citizens more and better products than they do.

It is hardly possible to misrepresent in a more thorough way the fundamental fact of economics. The average standard of living is in this country higher than in any other country of the world, not because the American statesmen and politicians are superior to foreign statesmen and politicians, but because the per-head quota of capital invested is in America higher than in other countries. Average output per man-hour is in this country higher than in other countries, whether England or India, because American plants are equipped with more efficient tools and machines. Capital is more plentiful in America than it is in other countries because up to now the institutions and laws of the United States put fewer obstacles in the way of big-scale capital accumulation than did those foreign countries.

…[I]t is not a lack of “know how” that prevents foreign countries from fully adopting American methods of manufacturing, but the insufficiency of capital available [emphasis in the original].

Very interesting! He glosses over how it came to be that capital poured into America, neglecting to analyze how our founders employed Smith’s theories. Nothing here about the two crucial aims, ensuring national independence and the production of wealth. Mises nicely sums up the Smithian wisdom of promoting capital investment in domestic industry, however, when he sets aside his globalist philosophy just long enough to provide Americans with this excellent economic advice:

What is needed is to make the importance of these problems understood by everybody. No party platform is to be considered as satisfactory that does not contain the following point: as the prosperity of a nation and the height of wage rates depend on a continual increase in the capital invested in its plants, mines, and farms, it is one of the foremost tasks of good government to remove all obstacles that hinder the accumulation and investment of new capital [emphasis in the original].

Indeed. Trump for all his WWE smack talk grasps the truth about our economy that eludes our elites. Free trade for a wealthy country means capital flight, and only a return to the Smithian framework can prevent our economic ruin. And, irony of ironies, none other than Mises the economist himself would have agreed with the feasibility of a nationalist economics, even though Mises the philosopher would have loved to see globalist creative destruction come about, so as to build the perfect world imagined by ideologues on the progressive left and the neoconservative right.